Today the US-China war was confirmed. Earnings season was overall positive this week. Watch how the next earnings season plays out. China will not give up or give in. This whole showdown was procrastinated dating back to April. It’s on!

NoFluffBizRants

Please post below with factual, objective points that support your subjective point of view.

-

Top Economists predict market crash coming

Both Andrew Ross Sorkin and Jamie Dimon, Chase CEO have both predicted a stock market crash and “major correction” coming shortly.

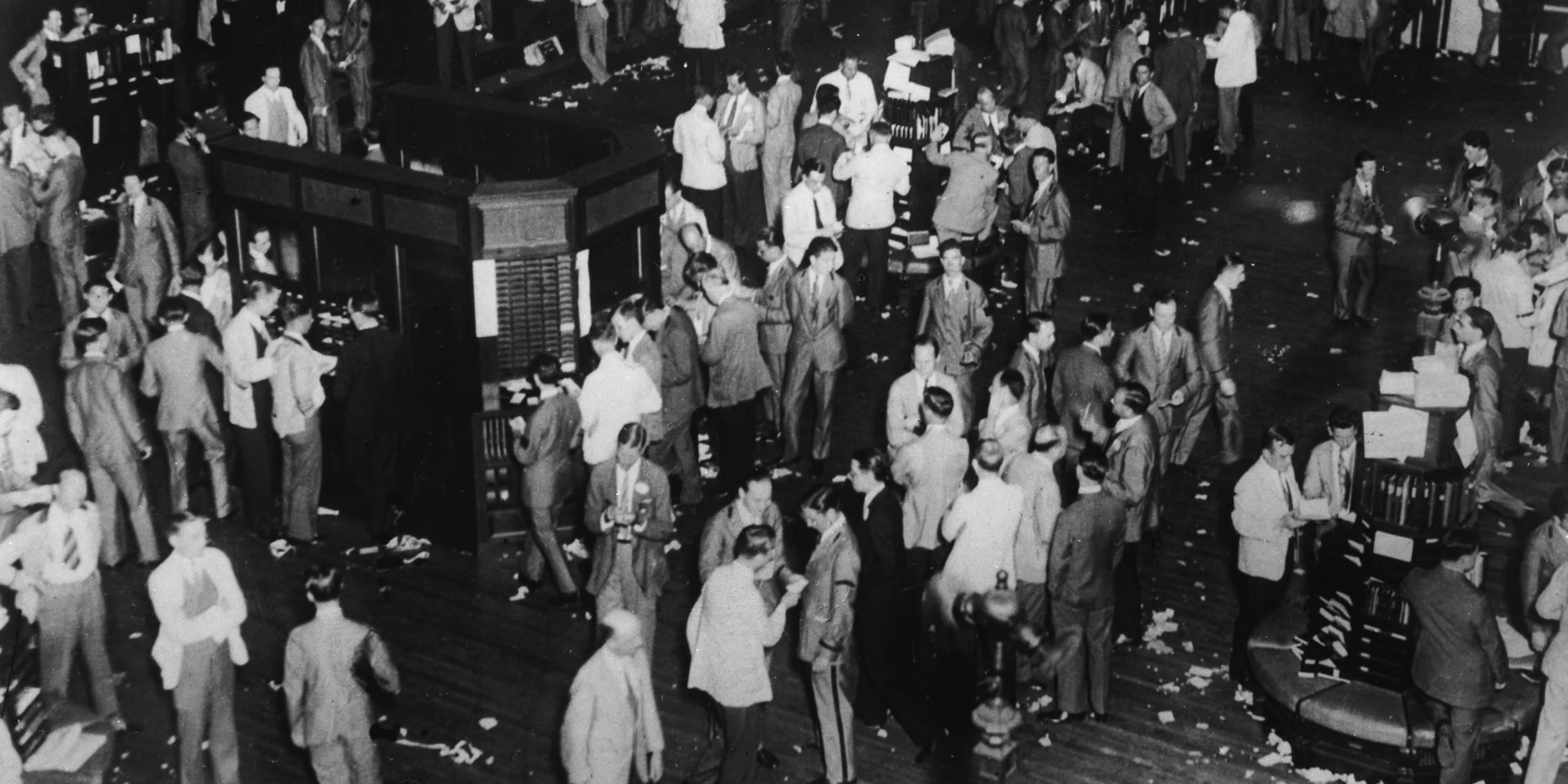

Sorkin compares the situation in 1929 to the current market:

As of mid-October 2025, Jamie Dimon, the CEO of JPMorgan Chase, believes the US market is at a higher risk of a significant correction than others perceive. He cites multiple factors, including high valuations, geopolitical tensions, and an uncertain economic outlook, as reasons for his concern.

https://www.foxbusiness.com/markets/jamie-dimon-warns-major-market-risk-next-few-years

If you are in long positions, GET OUT before the tidal wave hits shores!

-

China Countermeasures?

China retaliated with the threat of “countermeasures” in response to the future trade wars. Revisit China’s long history regarding how committed they are to not feeling like they are bullied by anyone to get a glimpse of how long this will last in the years ahead. To truly understand China’s importance on the US and global economy, one needs to fully understand the magnitude of China’s impact to the national debt and the production of consumer goods made in China.

-

AI Stocks Sell-Off Coming!

With the recent news that China is clamping down on exporting Raw materials that serve as the underpinning of AI Chips, the AI stock surge is OVER! Se Acabo! The Nasdaq, S&P and Dow that have been banking so hard on “AI darling” stocks are about to tumble real fast.

The rare earth materials that China is placing restrictions on are essential for the production of many computer chips, which are used in everything from smartphones to artificial intelligence systems.

The Rare Earth material restrictions placed by China are the most targeted action to limit supplies of rare-earth materials. This move is a follow-up from the April tariffs with China that were never rectified, and will result in China exercising long-arm jurisdiction over foreign companies to target the semiconductor industry.

The Export Controls China recently placed on Rare Earth materials may lead to week-long delays in shipments to companies like NVDA. The clearest risk all these “AI darling” companies face is an increase in the prices of rare earth-dependent magnets that are critical to the chip supply chain,

Ask yourself, why do you think NVDA was so concerned a month ago with gaining access to the China markets? It’s not solely focused on the revenue generated from sales in China, but rather creating a stronger relationship in the government where the nucleus of their product is created.

This move will have a direct impact on the AI Darlings of late: NVDA, AMD, Apple, Oracle, etc….the prettiest girls in the Ballroom this past summer.

This is the thesis behind this post: The AI Boom is about to become the AI Burst!

-

China Tariff’s – The straw that broke the camels back

The recent enforcements on China to levy “massive tariffs” was the triggering event for repercussions we are about to see in the stock market for the next 2 years. The stock market has been on a historic tear for the past 5 months, dating back to April 4th when the market tanked as a result of the tariff introduction. The real question we have to ask ourselves is: Did we really resolve the fear of the tariffs dating back to early April or did we just “kick the can” for 5 months and let AI enthusiasm dictate the market surge? No more room to kick the can when you’ve kicked it as far as it can go on a dead end ally. As Jamie Dimon correctly predicted, a major correction is in store for the stock markets. Time to face the music!

-

Market Crash Wolf Totem

Stock and Bond Market crash coming Halloween 2025. Spreading Into 2026 and beyond

-

Federal Government employees to be laid off

With the birth of AI bots taking over the private sector and more federal government employees being laid off the Unemployment rate will rise.

-

Is NVDIA overpriced?

Was NVIDA exposed yesterday by Oracle’s revelation that the AI chip essentially added no value after a $100M investment?

-

Goldman CEO gets it wrong!

Last week the CEO of Goldman Sachs stated the economy is “still in pretty good shape” and appears poised to accelerate into 2026.

Let’s revisit these numbers at the end of 2025 on 12/31/2025 to understand how David Solomon got it wrong.

GDP- 3.8%

Unemployment Rate-4.3%

****Watch the impact of machines replacing humans will have on the Unemployment rate****

Stock Indexes:

DOW- 46,758

Nasdaq – 22,780

S&P – 6,715

The real question is: Why did David Solomon get it wrong?

He knows the truth, specifically where the economy is heading as can be seen with this comment:

“I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets … I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.”

So why did David Solomon get it wrong?

Answer: The hedge funds are lining up their own funds to take short positions in the market and make a pile of cash.