Open AI does produce valuable Generative AI tools that we all find valuable. But is it irreplaceable? and is it really as valuable as all the money being poured into it? Why can’t over companies like Anthropic or the many AI companies created now replace the Gen AI features outputted from the Chat GPT engine?

The real question is: Does Open AI currently turn a profit?

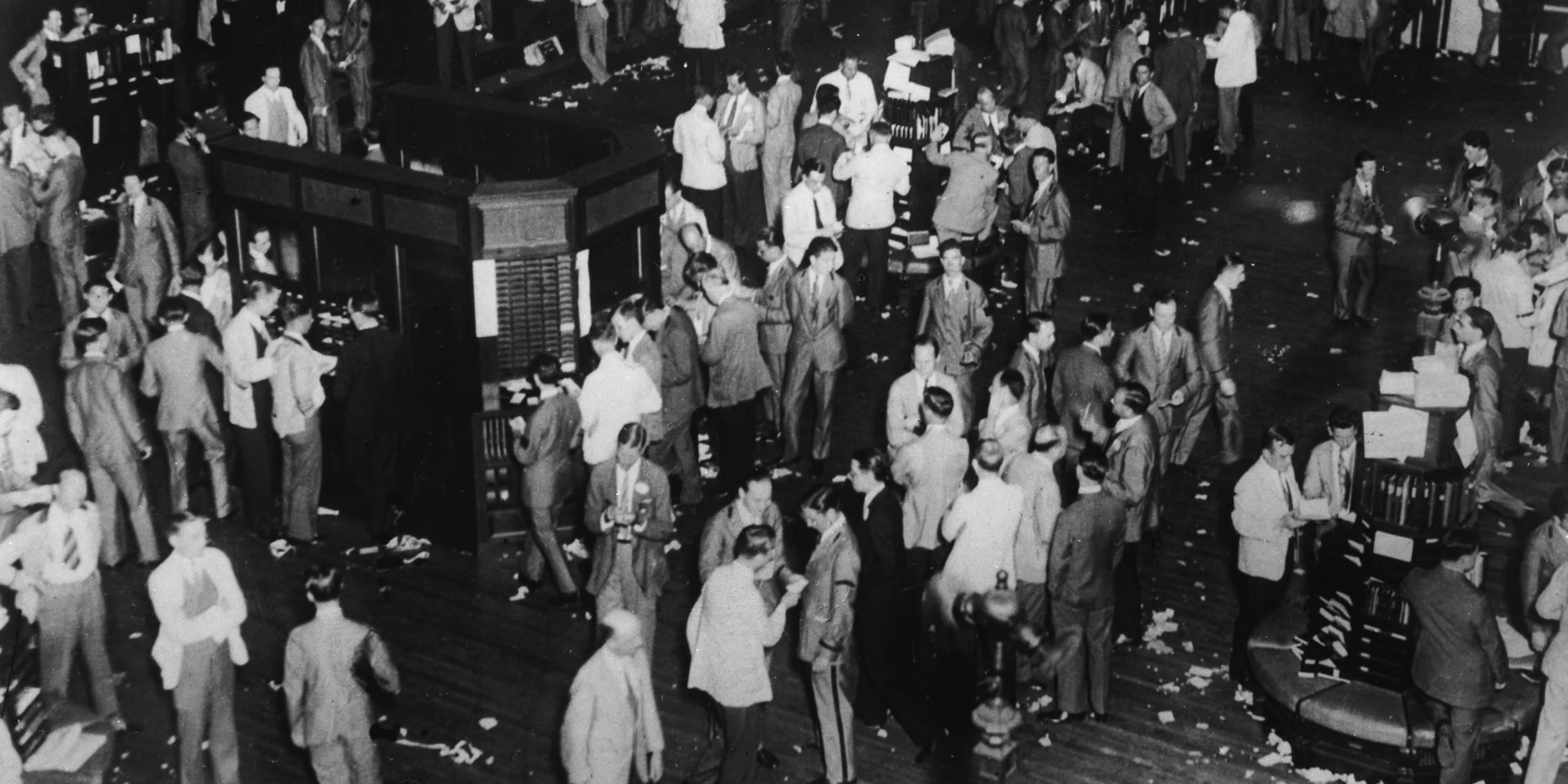

The San Francisco-based company has not yet turned a profit. With all the money poured into Open AI, it could also amplify concerns about an AI bubble if the generative AI products made by OpenAI and its competitors don’t meet the expectations of investors pouring billions of dollars into research and development.

There is no major life function: eating, sleeping, drinking, mating that Open AI remotely solves. It’s a nice to have that makes automated processes more efficient.

The near future over the next 2 to 3 years will answer the question regarding whether these investments into Open AI will payoff, or generate massive write-offs on the balance sheets of the companies investing.